When Johann Steynberg, the enigmatic CEO of Mirror Trading International (MTI), boarded a Qatar Airways flight to São Paulo from Johannesburg on December 2 2020, it was as if he stepped off the face of the earth.

Along with him disappeared 6,900 bitcoins – valued at R2bn at the time – leaving a wave of panic among thousands of investors.

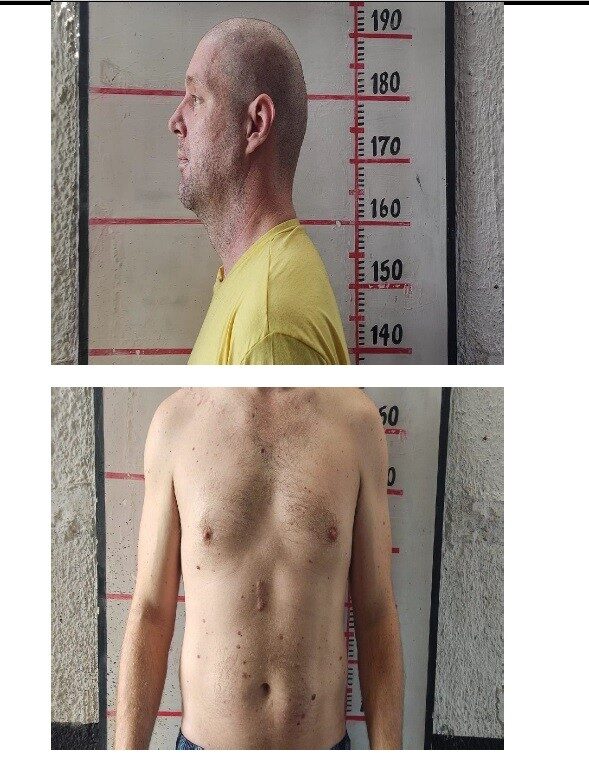

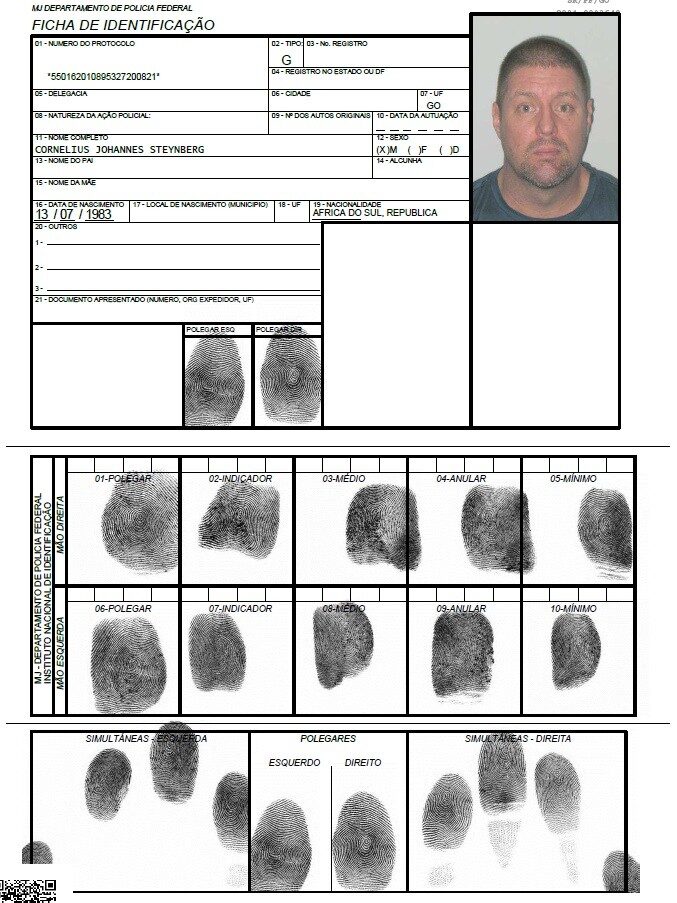

A year later, the South African fugitive was finally tracked down in Goiânia, a city of about 1.54-million people in Brazil’s interior and agricultural heartland. There, he was arrested and charged with the possession of two fake IDs.

A federal judge ordered that Steynberg be kept under house arrest on suspicion of being involved in money-laundering.

The man who once proclaimed himself a cryptocurrency savant now stood accused of running one of the country’s largest crypto Ponzi schemes. He fought an extradition request to his home country until reports of his death from a pulmonary embolism, at just 40 years old, surfaced in April this year.

Questions over whether he faked his death have swirled since. Currency pieced together bits of the life he lived while on the run, using court documents from a Brazilian online justice platform and following a visit last month to the Latin American country.

The final message home

It was 1.51am on December 15 2020 when Steynberg sent his wife, Nerina, his last known message to South Africa. The note said he was stepping out for dinner and would continue processing investor withdrawals upon his return.

He had already made 3,000 withdrawals as part of MTI’s efforts to perform damage control by paying out concerned investors. The firm had come under increased scrutiny after financial watchdogs in the US and Canada, and South Africa’s own Financial Sector Conduct Authority (FSCA) warned that MTI was a Ponzi scheme.

Just two months earlier, the FSCA had raided MTI’s offices and the homes of its executives, including that of Steynberg.

Hours after his message, an automated email notified Nerina and Steynberg’s business partner, Clynton Marks, that he hadn’t logged into MTI’s system for 12 hours. As he was apparently the only one with access to critical systems, MTI staff went into a flat panic.

By December 19, MTI staff released a statement on Telegram expressing their concern: “We are extremely worried, and a missing persons case has been filed.” Just three days later, MTI management issued another statement, saying Steynberg was “alive” and “in Brazil as far as we know”. The next day, however, he failed to board his scheduled return flight, sending anxiety levels among investors soaring.

Steynberg’s disappearance left MTI in shambles, with the firm unable to pay out rattled investors and the company already under investigation by the FSCA.

On December 29 2020, the Western Cape High Court placed the company under provisional liquidation, citing evidence that MTI had been operating as a Ponzi scheme. Investors’ funds – in the form of bitcoins – were unaccounted for. MTI would eventually go into final liquidation in June 2021.

For MTI’s investors, the fallout was devastating. They had believed Steynberg’s promises of consistent, sky-high returns, driven by an AI-powered trading algorithm. Instead, many were left with empty wallets and questions that no-one but he could answer.

Luxury life on the run

Speculation about Steynberg’s whereabouts ran wild. Some believed he had never left South Africa and that the plane ticket to São Paulo was just a ruse. Others pointed to Panama, where Nerina claimed he had purchased a timber plantation.

His actual destination was São Paulo, where he rented an apartment in the high-rise Mandarim Building, located in the upscale Berrini district. With its Louis XVI-inspired front gate and 3m-high security walls, the 41-storey tower offers one-bedroom apartments starting at about R$8,460 (R26,000) per month, according to a local property listing.

From there, court documents reveal how, before his arrest, Steynberg had acted as a crypto investment broker on behalf of various clients in São Paulo, buying and investing tens of thousands of dollars’ worth of bitcoin through online platforms.

He lived an extravagant lifestyle, visiting a sex motel several times and spending more than $52,000 (more than R775,000 at the time) at a Louis Vuitton store in January 2021.

Steynberg chartered a helicopter under the name “Bitcoin Trio”, taking R$3,000 (about R8,000 at the time) trips to the beach, spending thousands of dollars at expensive restaurants and taking a private jet to fly himself and his then-girlfriend, her daughter and father to São Paulo from Goiânia – a 900km trip that a judge would later value at R$23,000 (over R73,000 at the time).

The dealer who made it all possible

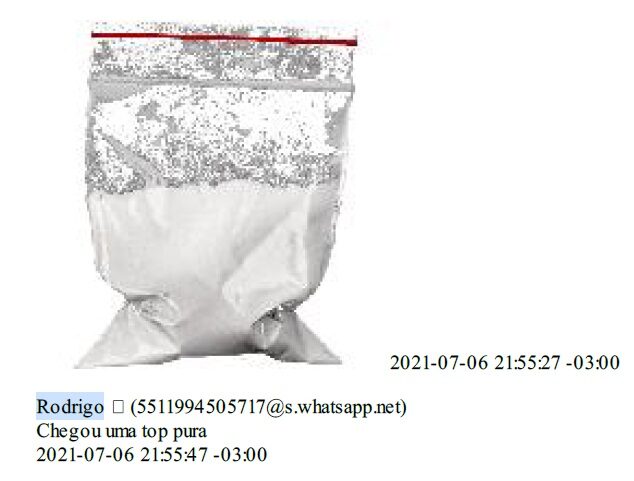

Much of Steynberg’s life on the run relied on a drug dealer known as Rodrigo. WhatsApp messages between the two reveal that Rodrigo arranged fake IDs and Covid vaccination certificates for Steynberg and his associate, Rafael Barros, and even supplied him with drugs.

Operating under aliases like “Cleisson Vieira da Silveira,” Steynberg likely used a translation app to communicate in Portuguese. In one exchange from June 2021, he asked Rodrigo to reprint a fake ID after the original was damaged.

“If possible, I’ll need it next weekend,” he tells Rodrigo, who responds that he’ll “send it to my bro and let you know”.

The conversation continues on June 29, 2021, when Steynberg tells him he has the photo ready and provides him with the address of a bar in the suburb of Itaim Bibi where Rodrigo can pick up the ID photo. By early July, Rodrigo also requested a signature and R$2,000 for the new ID, with Steynberg agreeing to meet at an upscale shopping centre.

The relationship extended beyond forged documents. Rodrigo once sent Steynberg a photo of high-grade cocaine, offering it for sale and even delivering it to his apartment.

In August 2021, Steynberg requested fake Covid certificates for himself and Barros, explaining they needed them to travel, despite not believing in the vaccine. Rodrigo charged R$2,000 per certificate and fraudulently registered their details in Brazil’s vaccination system.

In October of that year, a mysterious incident seemed to indicate Steynberg was having trouble getting access to cash. He had been trying to get a gambling company to pay him out the $400,000 (about R5.8m at the time) for bitcoin, which he claimed had been “stolen” in December 2020 when he was robbed of his phone, and that the bitcoin in question had ended up in an online casino, Bitstartz.

In an online support chat, in which he uses another of his aliases, Edson de Almeida, a Bitstartz customer support member called Jessica asks: “Surely, if you had 9.9 bitcoin in your wallet, you’d have some sort of password protection? Personally, I cannot send funds without face verification, so I am not sure how someone a) accessed your wallet and then b) sent the funds to an address without any notification to you whatsoever.”

The response from the former Polokwane resident is telling (especially coming from an apparent IT expert): “I [am] not smart with technology and phones. I don’t know.”

She then asks how he got the nine bitcoins then (with a smiley face following it), commenting sarcastically that “crypto can be quite technologically challenging, even for me, and I am young!” Not unexpectedly, Bitstartz refused to even review the case.

Out of time

Steynberg’s escape plan unravelled on December 29 2021 – exactly one year after MTI’s provisional liquidation. Acting on a tip, Brazilian federal police apprehended him in Goiânia.

Police confiscated his iPhone and laptops, which revealed a trove of incriminating evidence, including WhatsApp conversations that hinted at money-laundering and illegal transactions.

His Brazilian arrest initially focused on his possession of two forged IDs, but the investigation soon expanded. Steynberg was accused of converting illicit financial assets into movable and immovable properties to disguise their origins.

The state prosecutor’s office in Goiás maintained there was evidence that Steynberg had been converting financial assets in Brazil into movable and immovable assets to disguise the criminal origin of the resources.

The prosecutor’s office stated that when questioned about media reports claiming he entered Brazil with 22,000 bitcoins, Steynberg exercised his right to remain silent, leaving the claims and the bitcoins’ whereabouts unverified.

South African liquidators later disclosed they were seeking to recover less than a third of that amount – the difference between what investors deposited and what they had received back. Earlier this year, the liquidators demanded that investors who withdrew bitcoins from MTI repay the funds at their current value. They are now distributing the remaining assets from the scheme to members, based on their reported returns.

Steynberg told investigators only that he was training clients in Brazil online about cryptocurrency, while operating as an investment broker.

Police also discovered that he was part of a WhatsApp group called “Bilionaire [sic] Boys Club”, where members commented about bitcoin trades, and another called “Crypto Dinner”, in which Barros, for whom Steynberg acted as an investment broker, was a member.

But, while much was revealed about his life from his dealings with Rodrigo, it was his relationships with two women, both at about the same time, and him and his “best friend” personal trainer that set the stage for his downfall.

Look out for part two in this series next week.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.