It’s budget time again, just like three weeks ago. However, finance minister Enoch Godongwana did actually stand up and deliver the budget in parliament, unlike on February 19, when it was aborted at the 11th hour over a contentious plan to hike VAT from 15% to 17%.

This time, Godongwana trimmed back the tax proposal, saying VAT will be raised to 15.5% this year, and 16% next year.

Only, just like three weeks ago, the DA has said it will not support this budget, which means that the fiscal plan will not get a parliamentary majority. Unless, of course, the ANC is able to convince Jacob Zuma’s MK Party and the EFF to vote in favour – a deeply unlikely scenario.

DA leader John Steenhuisen said Godongwana has tabled a budget that “does not have a majority”, saying he could not support a programme that “raises VAT by 1% over two years without a clear commitment to the economic reforms”.

He told Currency that the DA had compromised repeatedly but the ANC, the largest party in the coalition government, had given nothing. “They refuse to share power,” he said.

The R60bn hole, he said, could be filled without hiking VAT, but only if the ANC is “willing to cut wasteful spending on projects that are unnecessary”.

This suggests South Africa is in for a budget stalemate, but Steenhuisen said Treasury still “has some room if they want to actually compromise”, as the fiscal framework will only be tabled on April 2. But he seemed sceptical that it would.

It is remarkable that, after the budget interruptus of February, Godongwana has tabled another budget without agreement, even though there have been three weeks in which much behind-the-scenes horse-trading has taken place.

As he stood up to give his speech, Godongwana began with “an apology to all South Africans”, adding that the postponement was a “regrettable, but perhaps an understandable feature of multiparty governance – it is a sign of a maturing and resilient democracy”.

The DA had demanded specific concessions – such as an Elon Musk-style “spending review”, including an audit of ghost workers, and a commitment to concession out the Cape Town and Richards Bay ports – in exchange for supporting a lower wage hike.

Godongwana said: “We are not deaf to the public’s concern about wasteful and inefficient expenditure. We know that we must earn the taxpayer’s trust every day, by spending public money with care and ensuring that every rand collected is spent on its intended purpose.”

This consolidated review of spending – including efficiencies in administrative functions, like how many offices the state rents, its vehicle fleets and overtime, to measuring the effectiveness of health, education and housing programmes – will be presented to cabinet in the next month. But without the DA in agreement, it is unclear what happens now.

What South Africans have won on the swings, they have lost on the roundabouts. In his undelivered budget, Godongwana had adjusted personal income tax tables for inflation, which put more money back into people’s pockets. Now, he has reversed this plan, which means that, after inflation, most workers will walk away with less pay at the end of each month.

Elsewhere, the National Treasury will draw down on R21bn contained in the special fund set aside for disaster relief to plug the hole in its budget. And it lowered the amount it needs to provide to Eskom.

“The money has to come from somewhere,” director-general Duncan Pieterse told reporters before Godongwana’s speech. The Treasury is working on reducing infrastructure disaster risks while also increasing its use of its insurance to deal with emergencies.

Steenhuisen’s complaint is that this was not a “pro-growth” budget, but rather relies on spending, spending, spending. And more taxes.

For instance, civil servants will still get higher-than-inflation salary hikes and an offer of early retirement packages at a cost R11.1bn; there are above-inflation increases in welfare grants, an extension of a Covid-relief grant, and more support for the army in the Democratic Republic of Congo. All paid for by dipping deeper into taxpayer’s pockets.

In fact, the words “expenditure reductions” appear only on two pages of the National Treasury’s 225-page Budget Review – in the same sentence, which is repeated twice.

“Over the medium term, new spending pressures must be funded either through additional revenue increases or expenditure reductions or reprioritisations, which may include eliminating non-performing programmes.”

Splits in the GNU

Earlier, signs of disharmony in the government of national unity cabinet became clear when Godongwana spoke at a pre-budget press conference. There, he effectively accused the DA of trying to score political points using the budget, after it had already “lost the battle” on policies such as National Health Insurance and land expropriation without compensation.

Disputes with the DA are “above my pay grade”, the minister added.

Pieterse, also speaking past the political split, said the outcome of a spending review and the implementation of the recommendations will determine whether the savings will be permanent or just once-off.

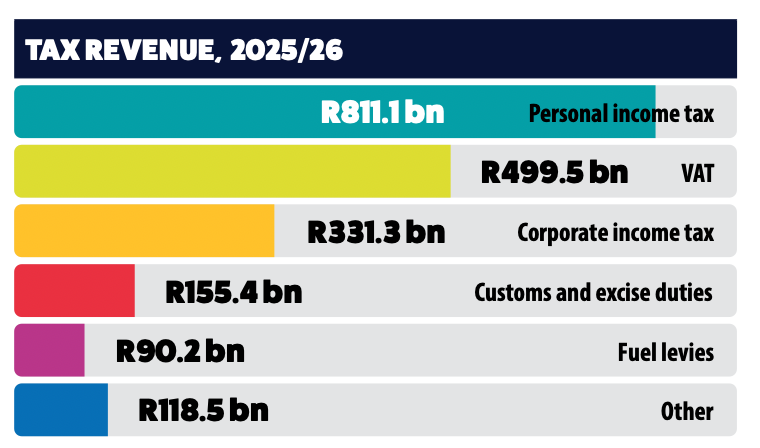

By not adjusting the personal income tax tables, the state will now raise an extra R19.5bn from salaried workers in the 2026 financial year, rather than the R3bn initially planned in February, with the changes effective from March 1. The first 0.5 percentage point VAT increase, which will take effect on May 1, will raise an extra R13.5bn in the 2025/26 fiscal year.

“Increasing taxes on consumption through a higher VAT rate will have the least detrimental effect on economic growth and employment … relative to increases in personal or corporate income tax rates,” the Treasury said in its Budget Review.

Were there to be hikes in personal taxes or corporate taxes, taxpayers would have found ways of paying less income tax, “with potentially larger negative impacts on the economy”.

Still, the Treasury is promising to offset the VAT increase by not raising the fuel levy and increasing the number of zero-VAT-rated basic food items consumed by low-income households, such as canned vegetables, poultry and other animals, and dairy liquid blends.

The National Treasury, though, admits that previous efforts of zero-rating essentials – there are 21 items in the basket – “did not appear to be fully passed through to lower-income households, indicating that this is a blunt approach”, adding in the same breath: “However, prices did decrease to provide some benefit.”

The VAT increase has another consequence: it will feed into inflation. The Treasury is forecasting that inflation will average 4.3% in 2025 and 4.6% next year, compared with 4.4% in 2024. And that implies interest rate hikes.

Ultimately, however, this may not be South Africa’s final budget, since it evidently doesn’t have enough political support. While the ANC might have hoped the MK Party would vote for it, the party’s parliamentary leader John Hlophe told reporters outside parliament: “The MK will definitely reject the budget in its entirety, particularly as it relates to the VAT increase.”

In the end, this debacle may say more about the word “unity” in the government of national unity, and the ANC’s unwillingness to recognise that it lost its majority last year.

Read Enoch Godongwana’s budget speech here:

Picture: Finance minister Enoch Godongwana. Gallo Images/Brenton Geach.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.